Export Polypropylene (PP) in 2025: Navigating Global Markets

Navigating the intricate world of global trade for Export Polypropylene (PP) in 2025 requires a comprehensive understanding of market dynamics, technical specifications, and logistical complexities. This article aims to provide buyers with a practical guide to securing their polypropylene needs, covering essential aspects from PP grades and HS code 3902 to MOQ, lead times, packaging, Incoterms, and the crucial COA.

Table of Contents

Executive Summary

- Key Market Focus for Export Polypropylene (PP) in 2025: Buyers should prioritize understanding specific PP grades and their applications, alongside stringent quality control measures evidenced by the COA.

- Logistical Preparedness: Familiarize yourself with packaging options (25kg bags, jumbo bags), standard Incoterms like FOB or CIF, and typical lead times to ensure smooth international transit.

- Compliance Essentials: Correctly identifying HS code 3902 is critical for customs clearance, while meeting MOQ requirements and preparing necessary documentation are vital for a successful transaction.

Understanding Polypropylene Grades for Export

The versatility of polypropylene (PP) is its defining characteristic, leading to a wide array of PP grades tailored for specific applications. When engaging in Export Polypropylene (PP) in 2025, it is paramount for buyers to clearly define the exact grade required. These grades are typically categorized by their molecular structure, melt flow rate (MFR), and additive packages.

Common PP grades include:

- Homopolymers: Known for their stiffness, heat resistance, and tensile strength. They are ideal for applications like rigid packaging (containers, caps), textiles (fibers, woven sacks), and automotive parts.

- Random Copolymers: Offer improved clarity, flexibility, and lower melting points compared to homopolymers. They are often used in transparent containers, films, and flexible packaging.

- Impact (Block) Copolymers: These grades exhibit superior toughness, especially at low temperatures, and good stiffness. They are highly suitable for durable goods, automotive components, industrial containers, and appliance housings.

The selection of the appropriate PP grade directly impacts the performance of the final product. For instance, a manufacturer producing clear food containers will require a random copolymer with high clarity and a specific MFR. Conversely, a company manufacturing industrial drums might opt for an impact copolymer for its robust impact resistance. Understanding these nuances is key to a successful Export Polypropylene (PP) in 2025 transaction. Always request detailed technical data sheets (TDS) from suppliers to confirm the specific properties of the PP grades offered.

Decoding HS Code 3902

The Harmonized System (HS) code is a universally recognized system for classifying traded products. For polypropylene, the relevant HS code 3902 is fundamental for customs declarations, tariff calculations, and trade statistics. Specifically, HS code 3902 covers “Polymers of propylene or of other olefins, in primary forms.”

This general heading is further broken down into more specific subheadings, depending on the exact form of the polypropylene, such as:

- 3902.10: Polypropylene, with a specific gravity of less than 0.94

- 3902.20: Polyisobutylene

- 3902.30: Propylene copolymers

- 3902.90: Other

Accurately identifying and using the correct HS code 3902 subheading is crucial for avoiding delays at customs, incorrect duty payments, and potential penalties. Importers must work closely with their customs brokers and suppliers to ensure the HS code declared matches the product being shipped, especially when dealing with various PP grades. Ensuring correct classification can significantly streamline the process of Export Polypropylene (PP) in 2025.

Packaging: The First Line of Defense

Proper packaging is critical in safeguarding polypropylene during transit and handling, especially when considering Export Polypropylene (PP) in 2025. The integrity of the product relies heavily on how it is packed and protected from moisture, contamination, and physical damage.

Standard packaging formats for polypropylene pellets include:

- 25 kg Bags: These smaller bags offer flexibility for recipients who require smaller quantities for specific batches or manufacturing processes. They are typically made of woven polypropylene or multi-wall paper.

- Jumbo Bags (Bulk Bags / FIBCs): Also known as Flexible Intermediate Bulk Containers, these large bags can hold between 500kg to 2000kg of material. They are an economical choice for bulk shipments and are made from durable woven polypropylene fabric.

- Super Sacks: Similar to jumbo bags, often used interchangeably.

For Export Polypropylene (PP) in 2025, suppliers usually offer a choice between 25kg bags stacked on pallets or packed directly into shipping containers, or shipment in jumbo bags. Palletizing 25kg bags provides stability and facilitates mechanical handling. Jumbo bags are efficient for large volumes but require specialized lifting equipment.Buyers should confirm with their suppliers about the available packaging, the number of bags per pallet, and the total weight, as these details impact logistics and handling costs. The choice of packaging can even influence stacking configurations within a shipping container, optimizing space and reducing freight costs.

Minimum Order Quantity (MOQ) and Lead Times

Understanding the Minimum Order Quantity (MOQ) and lead times is fundamental for effective planning and procurement when dealing with Export Polypropylene (PP) in 2025. These parameters dictate the scale of your initial commitment and the timeline for receiving your materials.

- MOQ: The MOQ represents the smallest quantity of polypropylene a supplier is willing to sell in a single transaction. This can vary significantly based on the supplier, the specific PP grades, and market conditions. For bulk commodities like polypropylene, MOQ is often expressed in metric tons (MT) and can range from a few metric tons for smaller suppliers or specialized grades to full container loads (FCL) or even vessel loads for larger producers. Always clarify the MOQ upfront to ensure it aligns with your production needs and budget.

- Lead Times:Lead times encompass the total duration from order confirmation to delivery at your designated port or facility. This period typically includes:

- Production time: The time it takes for the supplier to manufacture the requested volume of polypropylene.

- Quality control and testing: Time allocated for ensuring the product meets specifications, including the generation of the COA.

- Packaging and loading: Time spent preparing the material for shipment.

- Transit time: The duration of the sea or air freight journey.

- Customs clearance: Time variable depending on the destination country and accuracy of documentation.

Typical lead times for Export Polypropylene (PP) in 2025 shipments from major producing regions can range from 2 to 8 weeks for sea freight, depending on the origin, destination, and vessel schedules. Understanding these factors early in the negotiation process will prevent operational disruptions and allow for accurate inventory management.

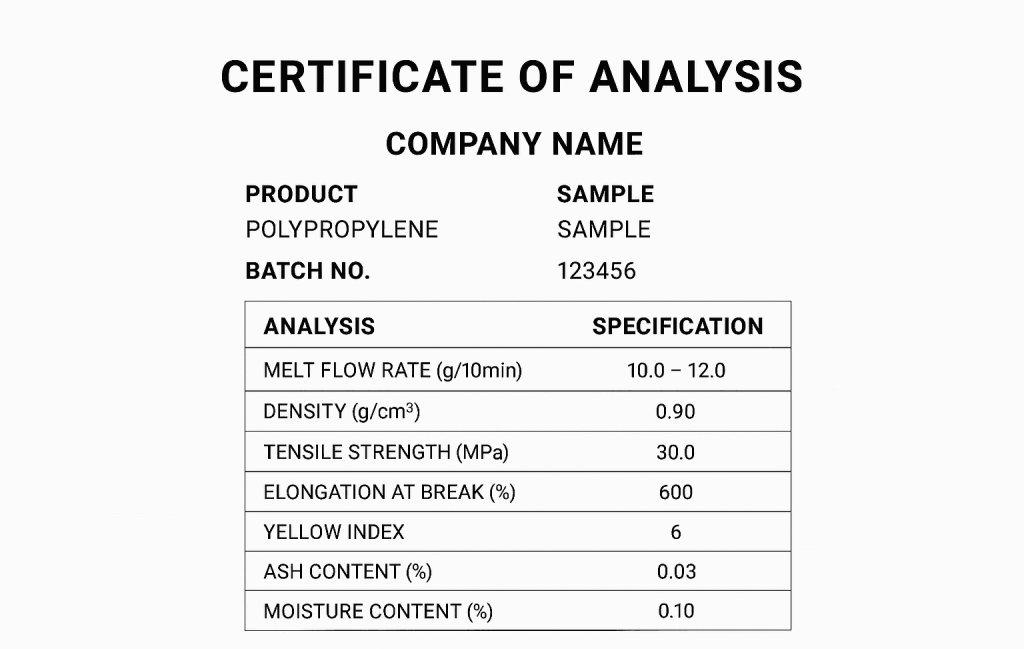

Documentation and Compliance: The COA and Beyond

Thorough documentation and adherence to compliance standards are non-negotiable aspects of international trade, particularly for Export Polypropylene (PP) in 2025. The Certificate of Analysis (COA) is a cornerstone document, but it is part of a larger compliance framework.

Certificate of Analysis (COA): A COA is issued by the manufacturer or an accredited laboratory. It certifies that a specific batch of polypropylene meets the agreed-upon specifications. A typical COA will detail key properties of the PP grades shipped, such as:

- Melt Flow Rate (MFR)

- Density

- Tensile Strength

- Flexural Modulus

- Impact Strength (Izod or Charpy)

- Ash Content

- Melting Point

The COA is your primary assurance of product quality and should be reviewed carefully upon receipt.

Other Essential Documents: Beyond the COA, several other documents are critical for successful Export Polypropylene (PP) in 2025:

- Commercial Invoice: Details the transaction, including product description, quantity, price, and buyer/seller information.

- Packing List: Enumerates the contents of each shipping unit (e.g., number of bags per pallet, weight per bag).

- Bill of Lading (B/L): The contract of carriage for sea freight, serving as a receipt for the shipment and title document.

- Material Safety Data Sheet (MSDS) / Safety Data Sheet (SDS): Provides information on potential hazards and safe handling procedures.

- Certificate of Origin (COO): Verifies the country where the goods were manufactured.

A comprehensive understanding of these documents ensures smooth customs clearance and minimizes disputes. For a successful Export Polypropylene (PP) in 2025 trading experience, ensure all required documentation is accurate, complete, and provided promptly by the supplier.

Compliance Checklist for Buyers

- [ ] Verify supplier’s ability to provide a COA for the selected PP grades.

- [ ] Confirm the HS code 3902 classification with your customs broker.

- [ ] Review sample COA and TDS before placing an order.

- [ ] Ensure the supplier understands and agrees to your required packaging standards.

- [ ] Confirm all required shipping and customs documents will be provided.

Logistics and Incoterms: Defining Responsibilities

The successful physical movement of polypropylene from seller to buyer hinges on robust logistics and a clear understanding of Incoterms. These international commercial terms define the responsibilities, costs, and risks associated with the delivery of goods from the seller to the buyer, playing a crucial role in Export Polypropylene (PP) in 2025.

Common Incoterms used for polypropylene exports include:

- EXW (Ex Works): The seller makes the product available at their premises (factory or warehouse). The buyer bears all costs and risks of loading the goods and transporting them to the final destination. This offers the buyer maximum control but requires significant logistical expertise.

- FOB (Free On Board): The seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment. Once the goods are on board, the buyer assumes all costs, risks, and potential loss of or damage to the goods. This is a very common term for bulk commodity exports.

- CIF (Cost, Insurance, and Freight): The seller pays for the cost of the goods, freight insurance, and the main carriage to the named destination port. The seller fulfils their obligation when the goods are on board the vessel. Risk transfers to the buyer once the goods are on board, but the seller has the responsibility to arrange and pay for insurance and freight to the destination port.

- CFR (Cost and Freight): Similar to CIF, but the seller is not obligated to arrange or pay for insurance.

The choice of Incoterms directly impacts who is responsible for arranging shipping, who pays for freight and insurance, and when risk transfers from seller to buyer. For Export Polypropylene (PP) in 2025, selecting the appropriate Incoterm is essential for financial planning and risk management. Always ensure the chosen Incoterm is clearly stated in the sales contract and that both parties fully comprehend their obligations. Understanding these terms is as critical as understanding the product specifications, including the COA and HS code 3902.

External Consultation: For in-depth guidance on international shipping and customs regulations pertaining to HS code 3902, consult resources from national trade promotion agencies like Austrade or the International Trade Administration. These organizations provide invaluable information on export procedures and compliance requirements.

Mitigating Risks and Handling Claims

International trade, while offering vast opportunities, inherently involves risks. Proactive risk mitigation and a clear process for handling claims are vital for successful Export Polypropylene (PP) in 2025.

Potential risks include:

- Quality Discrepancies: The received polypropylene not matching the specifications on the COA or TDS.

- Shipping Damage: Goods damaged during transit due to inadequate packaging or rough handling.

- Shortages: Receiving less quantity than ordered or invoiced.

- Delays: Significant deviations from agreed lead times, impacting production schedules.

- Documentation Errors: Incorrect or missing documents leading to customs issues.

To mitigate these risks:

- Supplier Vetting: Thoroughly research potential suppliers, request references, and consider site visits if feasible.

- Clear Contracts: Ensure every aspect of the agreement, including PP grades, quantity, packaging, Incoterms, MOQ, and delivery schedules, is clearly defined in written contracts.

- Pre-Shipment Inspection: Consider engaging a third-party inspection agency to verify the quality and quantity of goods before shipment.

- Cargo Insurance: For CIF or CFR terms, ensure adequate cargo insurance is in place. For other terms, investigate obtaining your own separate cargo insurance.

- Detailed Photographic Evidence: If any issues arise, document them immediately with clear photographs and videos.

In the event of a claim:

- Notify Immediately: Inform the supplier and, if applicable, the shipping line and insurer as soon as the issue is identified. Adhere to strict time limits for claim notification.

- Gather Evidence: Collect all relevant documents, including the COA, packing list, bill of lading, photographs, and any communication with the supplier.

- Formalize Claim: Submit a formal, written claim detailing the issue, the desired resolution, and supporting evidence.

A well-defined claim process protects your investment and helps maintain a good business relationship, even when challenges arise during Export Polypropylene (PP) in 2025. Understanding the nuances of HS code 3902 and ensuring correct documentation goes a long way in preventing claims related to customs compliance.

Conclusion and Call to Action

Successfully executing Export Polypropylene (PP) in 2025 requires meticulous attention to detail across multiple domains. From selecting the right PP grades and ensuring accurate HS code 3902 classification to managing MOQ, lead times, packaging, Incoterms, and relying on the COA for quality assurance, each element plays a critical role. By thoroughly understanding these factors and implementing robust risk management strategies, buyers can navigate the global polypropylene market with confidence, securing reliable supplies for their manufacturing needs.

For your upcoming Export Polypropylene (PP) in 2025 requirements, partner with experienced suppliers and logistics providers who prioritize transparency, quality, and efficient execution.